|

Contents

Connecting U.S. Agriculture: Ports-to-Plains Corridor

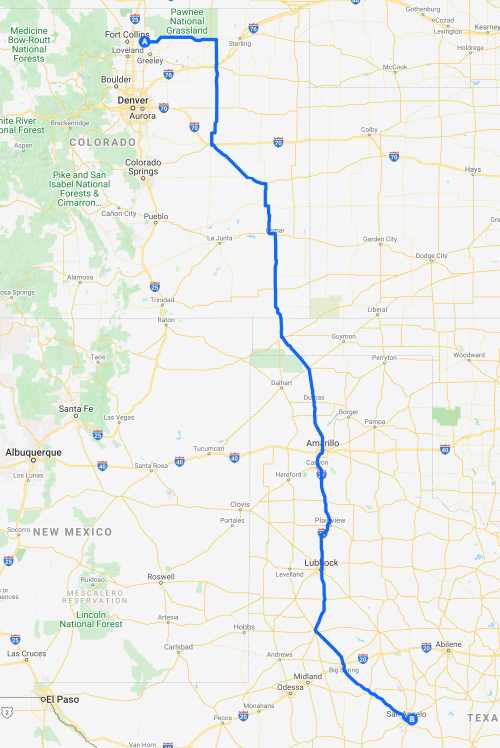

This month the Ports-to-Plains Corridor became the connection for a major investment in Texas by Colorado sheep producers. One of the primary talking points for the Ports-to-Plains Corridor is its importance to agriculture. In 2018, Texas and Colorado rank first and third in the nation, respectively in the number of sheep and lambs and Colorado is the most concentrated lamb feeding area in the United States.

The U.S. sheep industry, however, faced a significant loss when a primary production facility in Greeley, CO was closed earlier this year and is being sold to JBS. That facility was processing about 20 percent of U.S. lamb including about 350,000 lambs a year, and the big majority of those were Mountain States Lamb Co-op members. It left the industry short on processing capacity and especially in Colorado with its concentrated lamb feeding.

Enter Double J Meats/Double J Lamb Feeders in Weld County, CO. Double J Lamb Feeders, located outside Ault, CO, has a capacity for 60,000 head of sheep. It needed a processing facility to process those lambs. Double J Meats/Double J Lamb Feeders acquired the former Ranchers Lamb of Texas plant in San Angelo, TX, which was closed in 2005 due to lack of supply.

The Ports-to-Plains Corridor will provide the primary connection between Colorado and San Angelo, TX.

“San Angelo has always had a strong solid economy based on agriculture,” Mayor Brenda Gunter said. “We believe this lease will support the city’s long history of having a sheep and mohair business. At one time, San Angelo was the inland sheep and mohair capitol. We believe this is an important step in continuing to support the industry.”

“The San Angelo Chamber of Commerce welcomes the Double J Meat Packing company to our community,” said Walter Koenig, President, and CEO of the San Angelo Chamber of Commerce. “The reestablishment of this processing plant will drive growth in this critical sector and will provide lasting benefits to our local economy for decades to come.”

“The Economic Development Division of the San Angelo Chamber of Commerce continues to recruit new businesses to our community that bring us more jobs and new capital investment,” Chamber of Commerce Board Chair Clifton Jones said. “As Board Chair, I am proud of the excellent work that Vice President Michael Looney is doing in this regard for our city. We are excited to welcome the Hasbrouck family to San Angelo and extend our best wishes for much success to Double J Lamb, Inc. – Texas.”

The new plant is projected to begin operation Double J Lamb, Inc. – Texas plant within a few months. The San Angelo plant was designed to process 1,800 head per day and will employ an initial workforce of 80 to 100 employees and is expected to process approximately 200,000 head of lambs per year.

The Ports-to-Plains Alliance salutes San Angelo, TX, Double J Meats/Double J Lamb Feeders and its owners, the Hasbrouck family.

Highlighting Future Interstate Economic Impacts in Texas

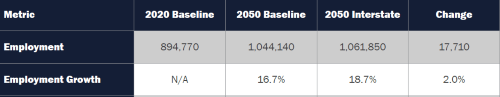

The following will continue to explore the economic impacts from the Ports-to-Plains Corridor Interstate Feasibility Study. These results were published in the Segment Committee Reports. The comparison are between the 2050 Baseline and the 2050 Interstate Upgrade. The 2050 Baseline is the current corridor highway system with the next ten years of TxDOT and MPO planned and programmed projects.

Future Interstate Effect on Jobs and Employment

By 2050, the interstate upgrade is anticipated to increase employment over the 2050 baseline by 17,710 jobs in the corridor and by 2,650 jobs in Segment #1, 7,280 in Segment #2, and 7,770 in Segment #3.

Compared to the 2020 baseline, the interstate upgrade is projected to increase employment from today, by 167,080 jobs across the corridor and by 20,140 jobs in Segment #1, 111,990 in Segment #2, and 34,940 in Segment #3. The entire Ports-to-Plains Corridor is projects to see an 18.7 percent employment growth from the current situation with the interstate upgrade by 2050.

In addition to the interstate projected economic impacts for the rest of Texas is estimated to Increase jobs by approximately 4,400 jobs.

Future Interstate Return on Investment

Return on Investment (ROI) is a common measure for determining whether an investment is worthwhile. In this case, it is calculated as the gain in GDP relative to the upfront capital investment.

Capital costs for upgrading the entire corridor is $23.5 billion. Over the first 20 years of interstate operations, statewide GDP gains total $55.6 billion, or $41.3 billion in new GDP once the time value of money (using a 3 percent discount rate) is taken into account.

Compared to the capital costs of $23.5 billion, this represents a return on investment of $17.8 billion or 76 percent. A 76 percent ROI means that the investment will result in 76 percent more benefit than the cost.

Future Interstate Benefit Cost Ratio

Another way of looking at whether a project is worth pursuing is the benefit-cost ratio (BCR), which compares economic benefits—such as travel cost savings and crash reductions—to capital and operating & maintenance (O&M) costs.

Statewide economic benefits of the interstate accumulate to $90.3 billion over 20 years of operations, which translates to $66.6 billion when discounted using a 3 percent rate.

When compared to total discounted costs of $27.4 billion, including capital and O&M, this reflects a benefit-cost ratio of 2.4. A benefit-cost ratio above 1 is considered a worthwhile investment.

Return to contents

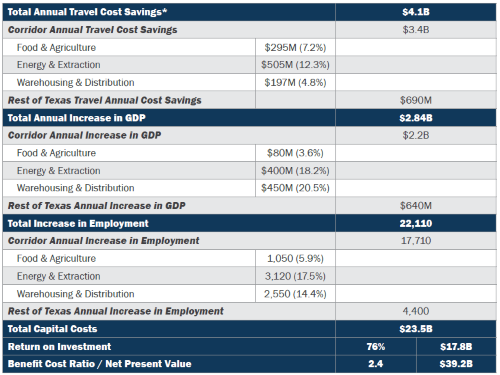

U.S.-Mexico GDP Impacts

This data is coming from the Draft Texas-Mexico Border Transportation Master Plan (BMTP). The BTMP identifies the cross-border challenges of moving people and goods and will include analysis of existing transportation systems--roadway, transit, pedestrian, pipeline, airport, maritime, and rail. The plan will analyze current and future transportation and will include a prioritized list of transportation investment strategies that support binational, state, regional, and local economic competitiveness and improve the impacts of cross-border trade and transportation. The Ports-to-Plains Alliance has participated in the Binational Regional Steering Committee for the Laredo-Coahuila-Nuevo Leon-Tamaulipas Region.

GDP Impacts Driven by Movement of Goods by Truck

Between 2017 and 2050 GDP driven by the movement of goods on the highway network using trucks is expected to grow $287 billion (288 percent) in the Laredo/Coahuila/Nuevo León/Tamaulipas Region served by Laredo, Eagle Pass and Del Rio.

On the U.S. side the growth is $187 billion (295 percent) and on the Mexico side GDP an increase of $99.9 billion (279 percent) is forecasted.

The movement of goods and highway network using trucks will increase U.S. jobs by 1.7 million (306 percent) and jobs in Mexico by 3.3 million (293 percent) in the Laredo/Coahuila/Nuevo León/Tamaulipas Region between 2017 and 2050.

Return to contents

Current Economic Cost of Highway Congestion within the Texas-Mexico Border Region

This information is also coming from the Draft Texas-Mexico Border Transportation Master Plan (BMTP). As explained below the economic cost to north-south corridor is the most significant and costly to users. In terms of the potential of the interstate upgrade to the Ports-to-Plains Corridor, by adding capacity to the north-south movement of goods, may reduce the forecasted delays to I-69, I-35 and I-10 as forecasted in the Ports-to-Plains Corridor Interstate Feasibility Study.

In 2017, highway congestion in the Texas-Mexico border region wasted nearly 158 million vehicle-hours on major corridors, valued at approximately $2.2 billion. Most of that congestion was concentrated in urban areas and around the border crossings.

Users of the main north-south corridors in the Texas-Mexico border region currently spend approximately 90 million vehicle-hours in delay annually. This is valued at approximately $1.3 billion for personally owned vehicles and trucks.

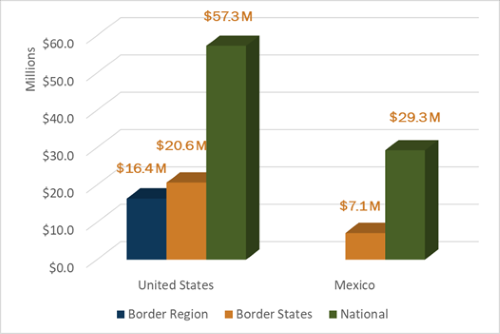

This roadway congestion reduces the demand for exported goods, which results in $9.7 million in lost GDP for the U.S. and $4.5 million in lost GDP for Mexico. Nearly three-fourths of that impact is due to congestion on north-south corridors.

Current Economic Impacts of Highway

Congestion on North-South Corridors (2017)

Future Economic Cost of Highway Congestion within the Texas-Mexico Border Region in 2050

By 2050, highway congestion in the Texas-Mexico border-wide region will increase significantly if current trends continue. Time lost to delays on major corridors will increase from nearly 158 million vehicle-hours to 2.9 billion vehicle-hours.

Highway congestion will increase considerably between 2017 and 2050. Total vehicle-hours in congestion will increase from 158 million hours in 2017 to 2.9 billion hours in 2050. Overall delay hours will increase by a factor of 10 on east-west corridors and by a factor of 20 on the north-south corridors.

Users of the main north-south corridors in the Texas-Mexico border region will spend approximately 2 billion vehicle-hours in delays in 2050. This time is valued at approximately $26.9 billion for personal vehicle and truck drivers per year.

This roadway congestion reduces the demand for exported goods, which will result in $70.6 million in lost GDP for the U.S. in 2050 and $35.5 million in lost GDP for Mexico. Nearly 80 percent of that impact is due to congestion on north-south corridors.

Future Economic Impacts of Highway

Congestion on North-South Corridors (2050)

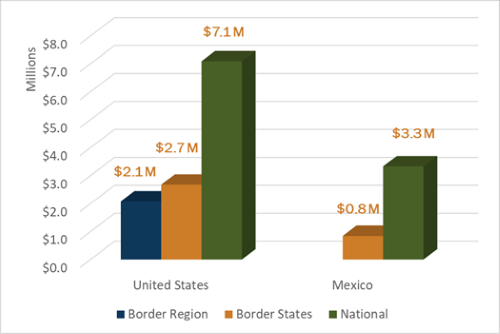

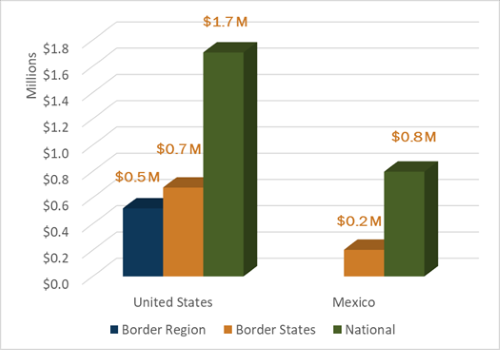

Cost of Highway Congestion within 100 miles of the Border

Highway congestion on major corridors within just 100 miles of the border lowers the GDP of the border region by $1.7 million in the U.S. and $0.8 million in Mexico in 2017. More than three fourths of the time spent in congestion is from personal vehicles. Congestion delays are expected to increase by 570 percent between 2017 and 2050.

- More than two-thirds of the time lost to congestion within 100 miles of the border is experienced by personal vehicles. They accounted for approximately 82 percent of the total time lost to congestion in 2017, and they will account for 78 percent of the time which will be lost in 2050.

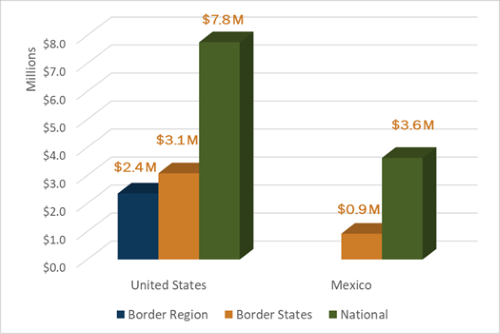

- By 2050, congestion on major corridors within 100 miles of the border will grow by more than 570 percent. In 2017, vehicles lost more than 16 million hours to congestion; by 2050 they will lose more than 111 million hours. The time lost in 2017 can be valued at $238 million and at more than $1.6 billion in 2050.

- Congestion along I‑35/FH 85 and I-10 currently delays trucks and personal vehicles the most. In 2017, approximately 80 percent of both total truck and personal vehicle time in congestion within 100 miles of the border occurs on those two corridors.

- From 2017 to 2050, congestion will worsen the most along I-69 at Laredo and Brownsville.

- Highway congestion within 100 miles of the border is responsible for $1.7 million less in U.S. GDP and $0.8 million less GDP in Mexico in 2017. By 2050, the impact of congestion with 100 miles of the border will limit GDP by $7.8 million in the U.S. and $3.6 million in Mexico.

Current Economic Impacts of Highway

Congestion within 100 Miles of the Border (2017)

Future Economic Impacts of Highway

Congestion within 100 Miles of the Border (2050)

Return to contents

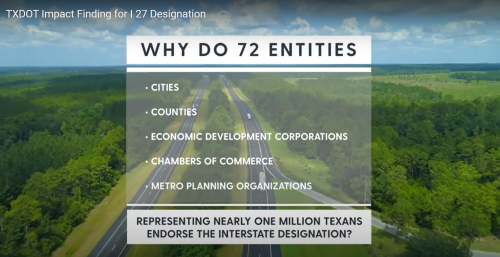

Check out the newest Ports-to-Plains Video!

Click to View This Video

Return to contents

|